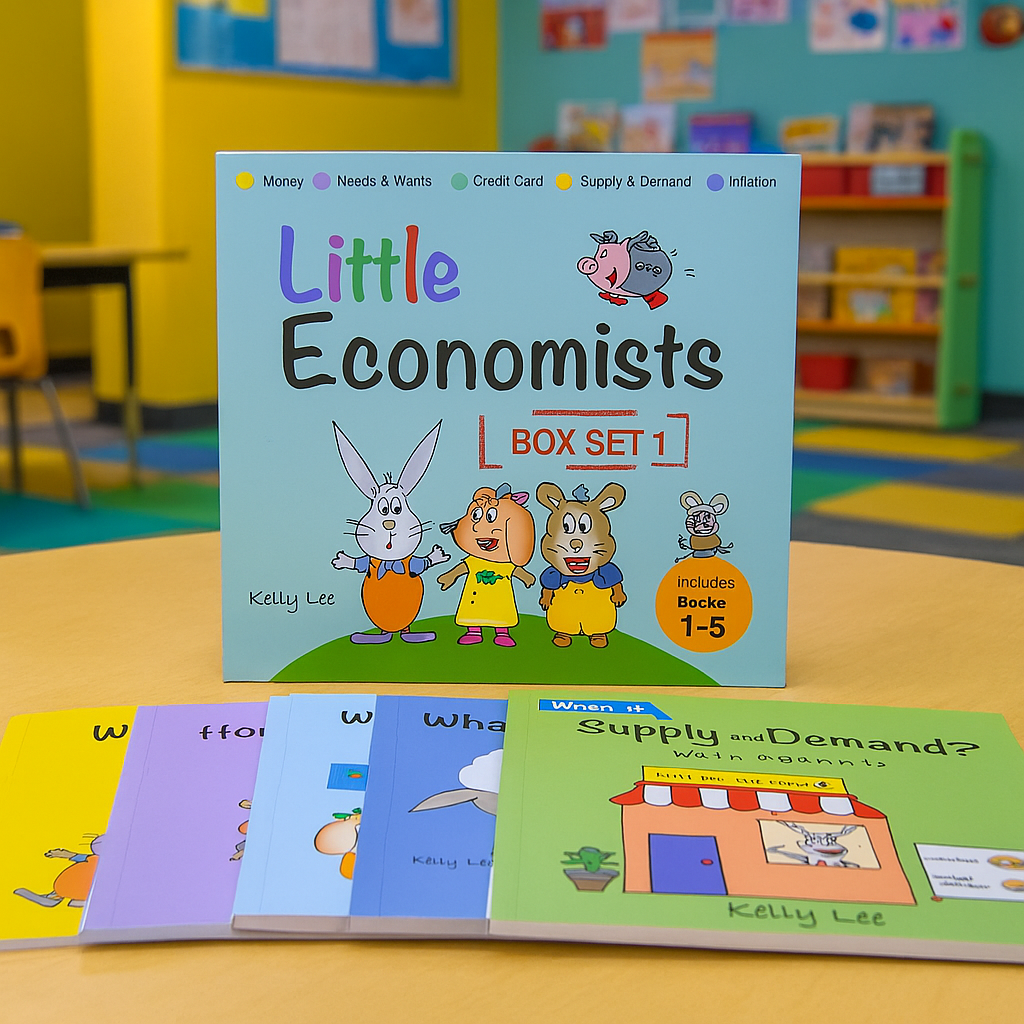

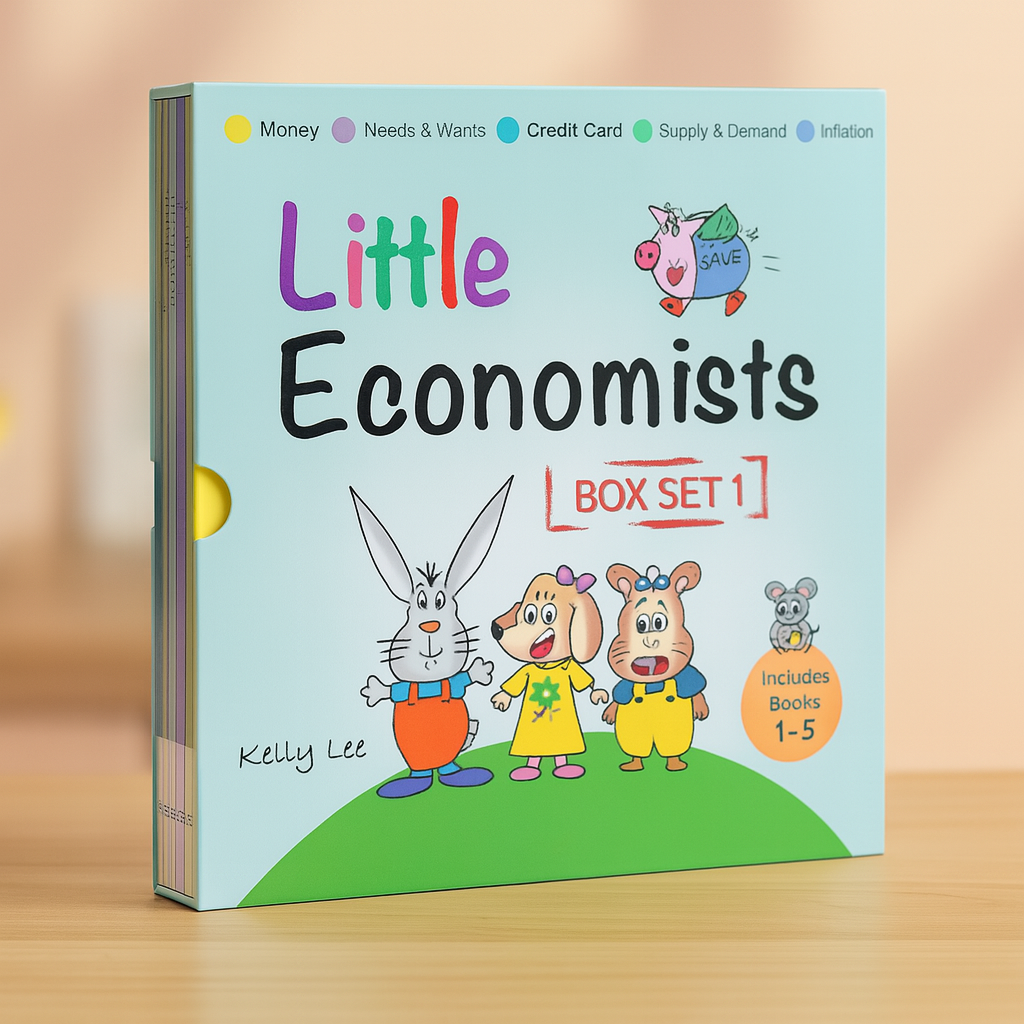

Little Economists (50% OFF)

Thousands of Kids Are Learning Smart Money Habits Early

Let Yours Be One of Them 🧠

Fun stories, smart lessons, and real-life money wisdom

made for growing minds.

When your child starts asking about money, spending, or “why things cost more,” this book set gives you the perfect way to teach real financial concepts without stress or confusion.

The top 4 features & benefits...

Real-World Money Lessons

From saving to inflation, each story turns complex topics into playful, kid-friendly lessons.

Built for Parent–Child Bonding

Spark meaningful conversations that help your child think critically about money and choices.

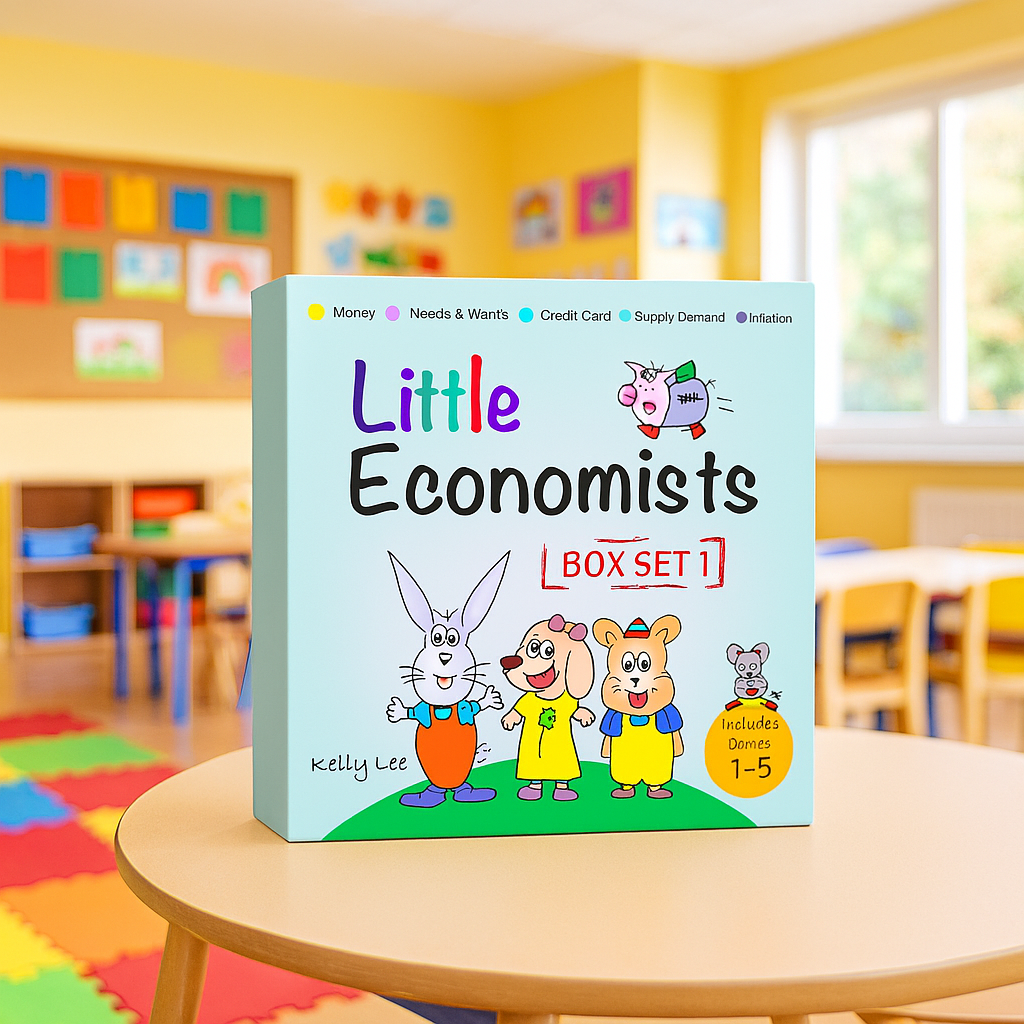

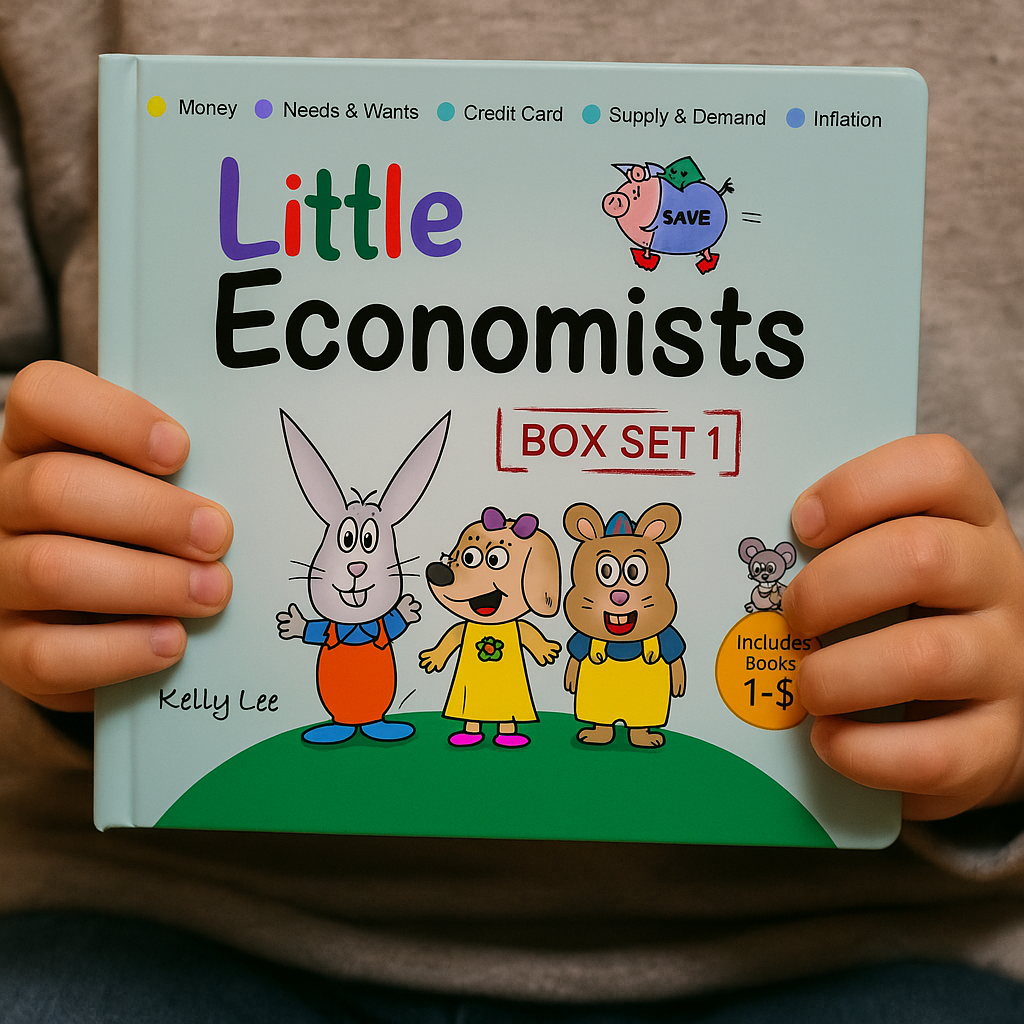

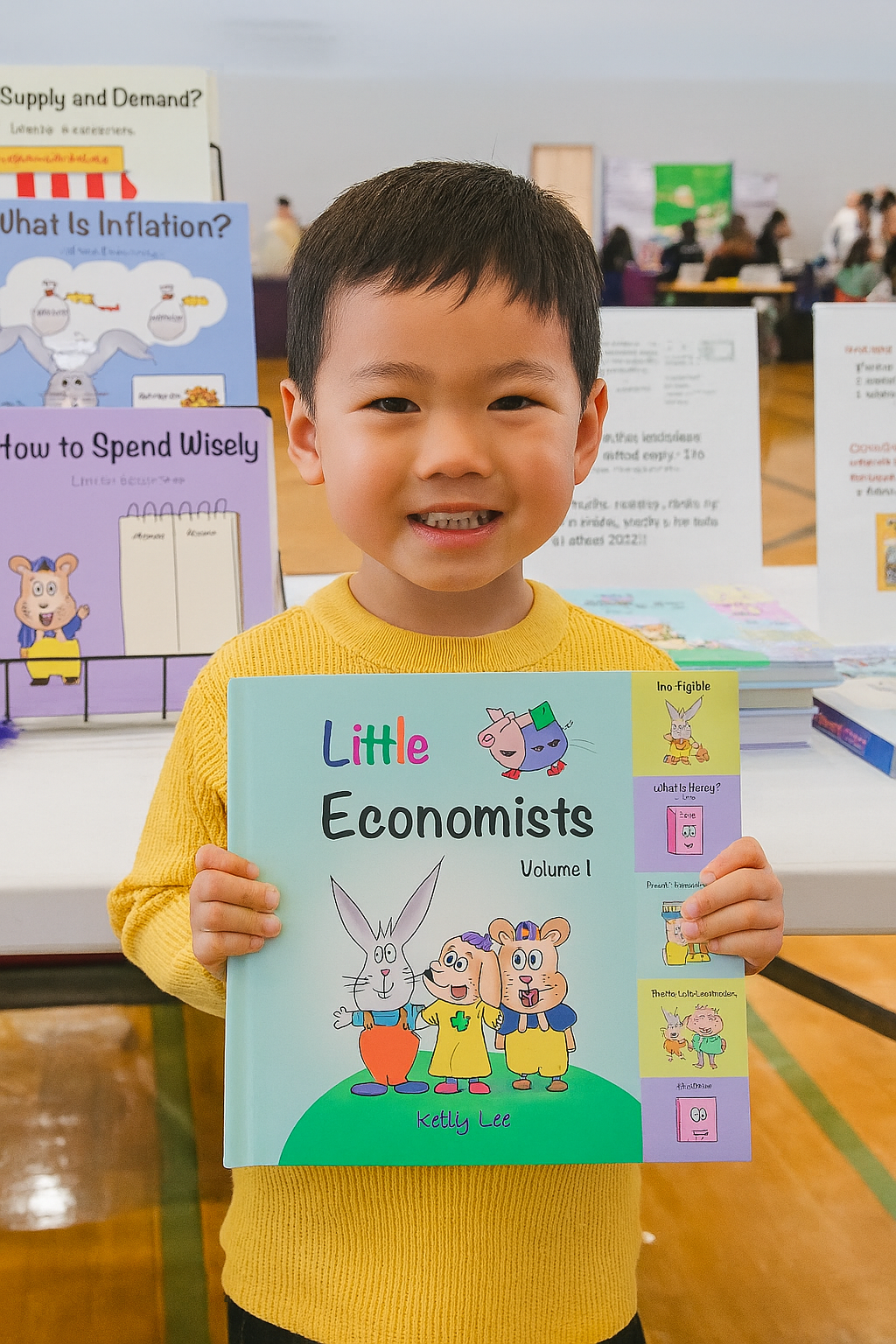

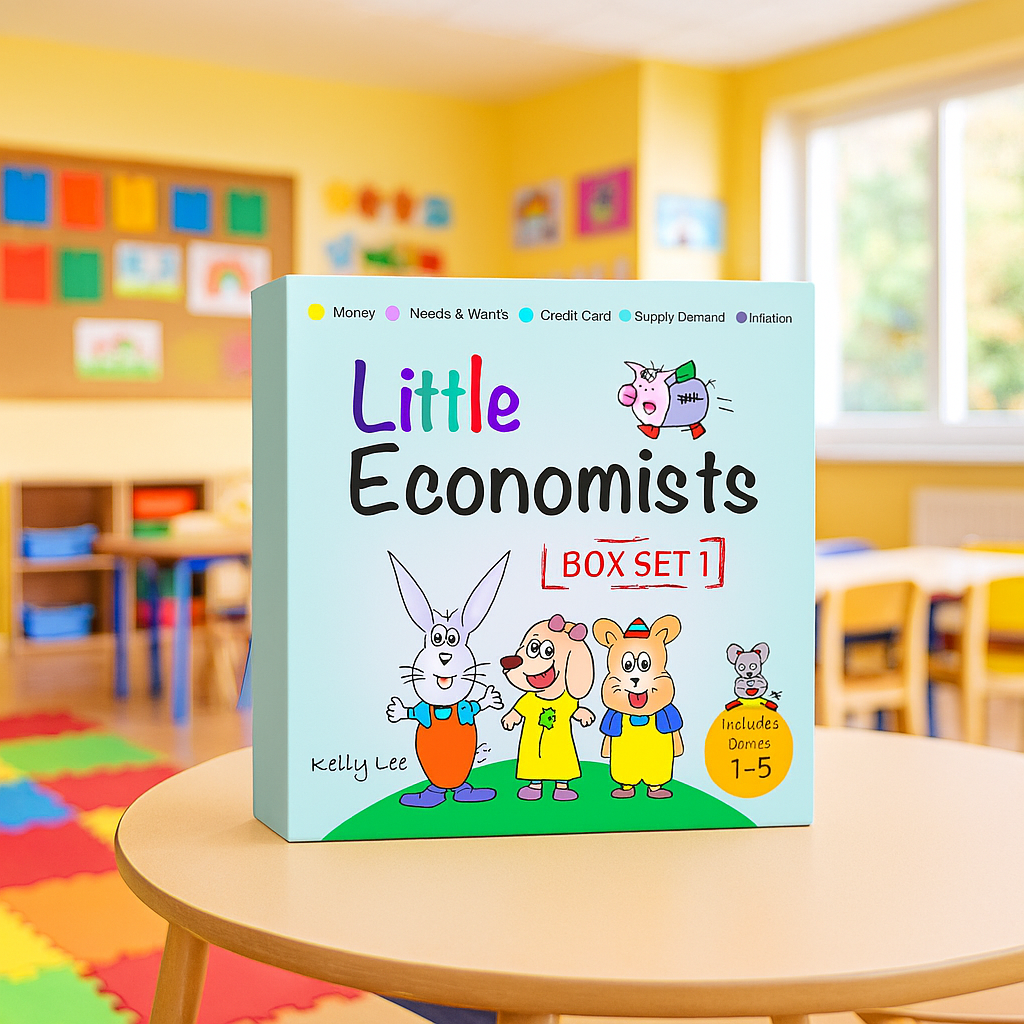

Colorful Characters, Big Impact

Engaging illustrations and lovable animal guides keep kids interested—and learning.

Lifelong Habits Start Early

Help your child build confidence, independence, and financial responsibility before it’s too late.

150,281+ Customers Worldwide

Over 5,000+ 5 Star Reviews

Financial Guidance When They Need It Most

When your child starts asking about money, this book set gives you the words—and the wisdom—to answer with confidence 💡

Whether they’re learning how to save, asking why things cost more, or curious about how money works, these fun and engaging stories offer clarity, conversation, and smart habits that stick for life.

Enjoy meaningful moments with your child while they learn real-world financial lessons—without confusion, stress, or screen time.

Rated 4.76/5 based on +1475 reviews

Thousands of families are building smart money habits, critical thinking & real-world readiness 🧠💬

Here’s what parents are saying about this powerful learning tool...

“Finally Understands Saving! 💰”

“Asked to Open a Piggy Bank 🐷”

“Wants to Talk About Needs vs Wants 🎯”

“Explains Inflation Better Than I Can 😅”

Confidence and Clarity When They Need It Most

Give Your Child the Skills to Thrive 💡

Raising kids in today’s world is tough—but teaching them about money doesn’t have to be. These beautifully illustrated stories make saving, spending, and smart choices simple, fun, and unforgettable.

Instead of dodging tough questions, you’ll have meaningful answers—and life lessons that stick. With every page, your child builds confidence, curiosity, and a real-world advantage that most adults never got.

Frequently Asked Questions about Little Economists

Here you’ll find answers to the most common questions parents and educators ask about this best-selling money series for kids. Need help? Contact our support team anytime!

Contact our support teamWhat educational value does this box set provide?

Little Economists introduces children to essential personal finance concepts—like saving, budgeting, credit, and inflation—at a developmental stage when lifelong habits are forming. It encourages critical thinking, problem-solving, and early financial responsibility in an age-appropriate, story-driven format.

How does this product support a parent or teacher's role in financial education?

The stories act as guided tools to facilitate meaningful conversations between children and adults. Parents and educators don’t need financial expertise—the content is designed to deliver key lessons naturally through relatable characters and situations, making it easy to reinforce values like planning, patience, and smart decision-making.

Why is early financial literacy important for children aged 4–8?

Research shows that children form their foundational money habits by age 7. Teaching financial principles during this critical period sets the stage for responsible behavior later in life—reducing future risks like debt mismanagement, impulsive spending, and poor saving habits.

What’s inside the book?

All of our material, including the full book and additional resources, is provided in a fully digital format. That means everything you access here is available online or via downloadable eBooks — no physical shipping involved. Whether you're reading on your phone, tablet, or computer, you’ll have instant access the moment you complete your purchase or registration.

What makes this series different from other educational books?

Unlike generic children’s books that touch on money briefly, this series dives into key financial topics with structure, clarity, and depth—without overwhelming young minds. The books combine economics, storytelling, and visual learning to keep children engaged while promoting real understanding.